Professional Rent Receipt Generator

📑 Table of Contents

- What is a Rent Receipt?

- Why is Rent Receipt Required?

- How Rent Receipt Helps in HRA Claim?

- How to Generate Rent Receipt Online?

- Importance of PAN & GST in Rent Receipt

- Rent Receipt Sample PDF Format

- Common Mistakes to Avoid

- HRA Tax Rules & Limits (India)

- Benefits of Our Free Rent Receipt Generator

- Frequently Asked Questions (FAQ)

🧾 What is a Rent Receipt?

A rent receipt is a written document that serves as proof of payment made by a tenant to a landlord for accommodation. It typically includes the amount paid, payment date, rental period, landlord and tenant information, and signature. Rent receipts are commonly used for tax purposes, particularly to claim House Rent Allowance (HRA) by salaried employees.

❓ Why is Rent Receipt Required?

Rent receipts act as verifiable documentation that a tenant has paid rent regularly. Most companies and government institutions in India ask for rent receipts when filing income tax declarations. If you claim HRA, providing a rent receipt is mandatory. Additionally, it builds trust and transparency between landlord and tenant.

💰 How Rent Receipt Helps in HRA Claim?

House Rent Allowance (HRA) is a key component of a salaried person’s income in India. To claim HRA deductions under Section 10(13A) of the Income Tax Act, it is mandatory to submit valid rent receipts. If the rent exceeds ₹1,00,000 annually, the landlord’s PAN is also required. Our rent receipt generator helps you generate compliant PDFs instantly.

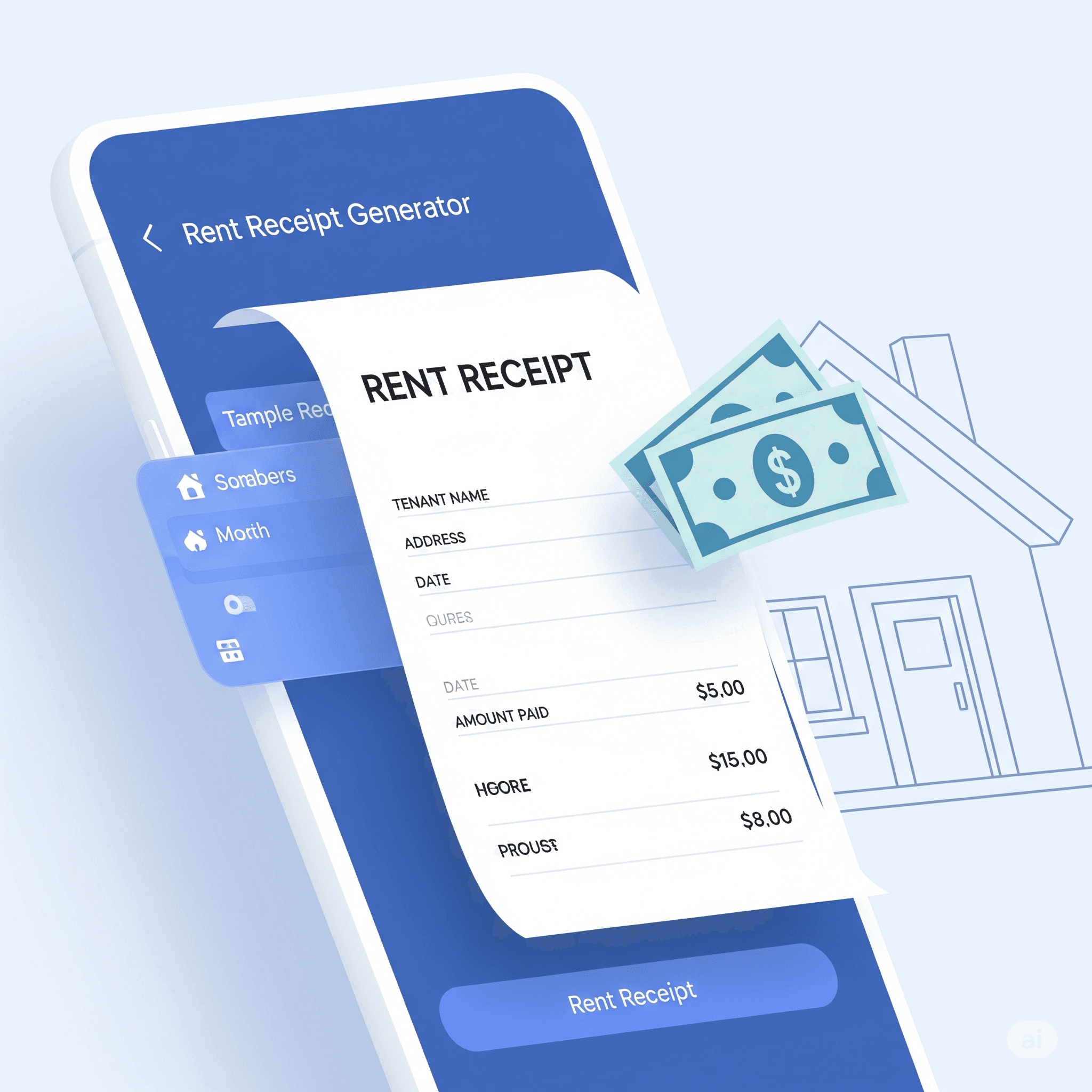

⚙️ How to Generate Rent Receipt Online?

- Visit our Rent Receipt Generator Tool.

- Enter tenant and landlord details like name, address, PAN, GST (if applicable).

- Select rental month(s) or year and amount paid.

- Click “Generate PDF”.

- Download or print the receipt instantly.

📝 PAN & GST in Rent Receipt

If annual rent exceeds ₹1,00,000, it is mandatory to provide landlord’s PAN. If the landlord is a business or property is commercial, GST details might also be required. Our generator supports both fields to ensure compliance.

📄 Sample Rent Receipt PDF Format

Here’s what our rent receipt includes:

- Tenant and landlord names

- Complete rental address

- Rent amount and mode of payment

- Rent period

- Landlord’s PAN and GST (if available)

- Date and digital signature block

Want to view a live sample? Click here.

🚫 Common Mistakes to Avoid

- Submitting rent receipt without PAN for >₹1L rent/year

- Incorrect rent amount or mismatch in months

- Wrong spelling of names or address

- Using handwritten, tampered receipts

📚 HRA Tax Rules in India

HRA exemption is calculated as the minimum of the following:

- Actual HRA received

- Rent paid minus 10% of basic salary

- 50% of basic salary (for metro cities) or 40% (non-metro)

For full rules, visit the official Income Tax India website.

🎯 Benefits of Our Rent Receipt Generator

- Free and fast – no signup needed

- Supports Hindi labels

- Monthly or annual receipt download

- Ad-free and mobile friendly

- Instantly downloadable professional PDF

🔧 Ready to Claim Your HRA?

Use our Free Rent Receipt Generator to create tax-compliant rent receipts instantly and claim your HRA without hassle.

🧾 Generate Rent Receipt Now🔗 Related Tools

❓ Frequently Asked Questions

1. Is rent receipt mandatory for HRA?

Yes, if your monthly rent is more than ₹3,000, then it’s mandatory to provide rent receipts for HRA claim.

2. What if landlord refuses to give PAN?

If rent exceeds ₹1,00,000/year and PAN is not provided, your HRA claim may get rejected or taxed.

3. Can I use this receipt for income tax return?

Yes. The PDF is professionally formatted and valid for HR and ITR documentation.

4. Is this rent receipt accepted by companies?

Yes. It meets the standard format used by corporates and HR departments for tax proof submission.